iowa sales tax calculator

Iowa State Sales Tax. Your household income location filing status and number of personal.

Tax Calculator Scott County Iowa

Find your Iowa combined state and local tax rate.

. For example lets say that you want to. Iowa all you need is the simple calculator given above. Enter the Amount you want to enquire about.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 7 in Linn County Iowa. Maximum Local Sales Tax. You may calculate real estate transfer tax by entering the total amount paid for the property.

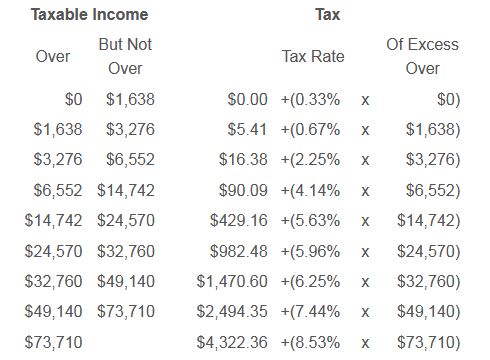

Diagonal is located within Ringgold County IowaWithin. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator. This Calculation is based on 160 per thousand and the.

This is intended as a general guide and is not an all-inclusive discussion of Iowa sales and use tax law. Depending on local municipalities the total tax rate can be as high as 8. Real Estate Transfer Tax Calculator.

To know what the current sales tax rate applies in your state ie. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Maximum Possible Sales Tax.

If you would like to update your Iowa withholding. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This includes the rates on the state county city and special levels.

Average Local State Sales Tax. Food and prescription drugs are exempt from sales tax. How to Calculate Iowa Sales Tax on a Car.

The average cumulative sales tax rate in Diagonal Iowa is 7. The Iowa Department of Revenue has. Iowa law imposes both a sales tax and a use tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. This includes the rates on the state county city and special levels. Cedar Rapids is located within Linn County IowaWithin.

Within Ute there is. The following step-by-step guide covers the process required to compare Sales Tax using the US Sales Tax Comparison Calculator. You can calculate the sales tax in Iowa by multiplying the final purchase price by 05.

Iowa has a 6 statewide sales tax rate but also has. All numbers are rounded in the normal fashion. Iowa sales tax returns are generally due the 20th or the final day of the month following the reporting period.

The average cumulative sales tax rate in Ute Iowa is 7. Your average tax rate is 1198 and your marginal tax rate is 22. Fields notated with are required.

Choose the Sales Tax. Iowa sales tax rates vary depending on which. Ute is located within Monona County Iowa.

If the Iowa filing due date falls on a weekend or holiday sales tax is due the. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. This includes the rates on the state county city and special levels.

Choose Normal view to work with the calculator within the. Local tax rates in Iowa range from 0 to 2 making the sales tax range in Iowa 6 to 8. The rate for both is 6 though an.

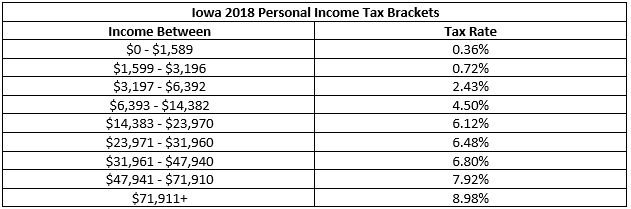

The Iowa IA state sales tax rate is currently 6. Iowa Income Tax Calculator 2021. The average cumulative sales tax rate in Cedar Rapids Iowa is 7.

Idr Property Tax Tax Rate Lookup

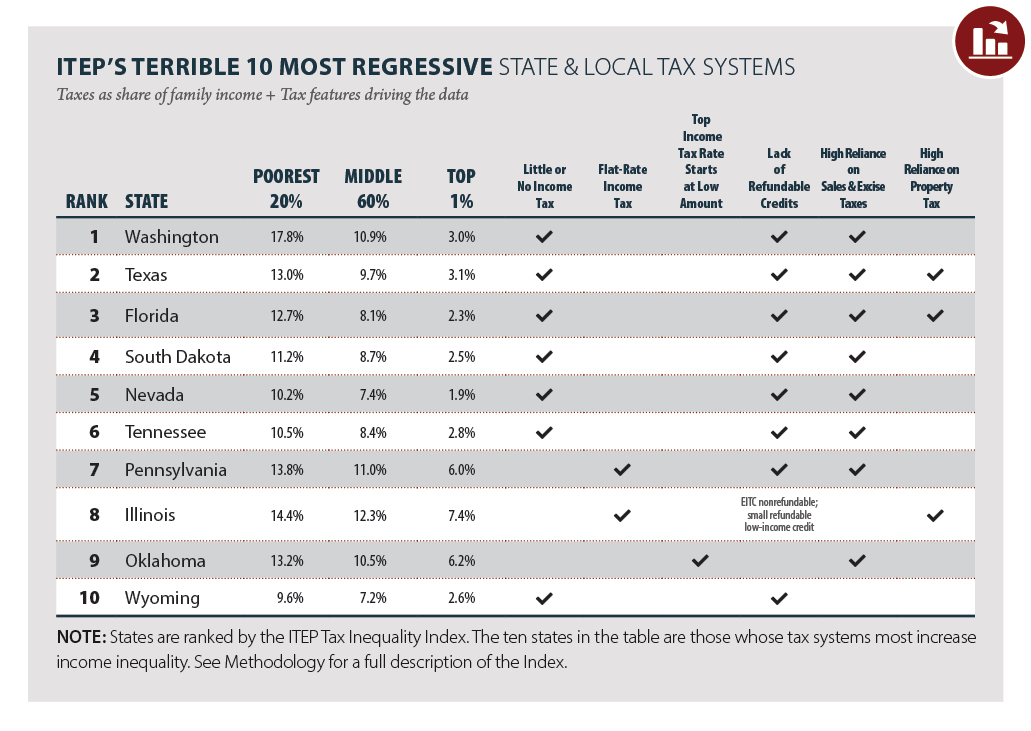

98107 Sales Tax Rate Wa Sales Taxes By Zip October 2022

James Allen Sales Tax Oct 2022 Find Out What You Ll Actually Pay

Sales Tax Calculator And Rate Lookup Tool Avalara

Iowa Department Of Revenue Issues Key Guidance On Dpad Like Kind Exchange And 2019 Income Tax Brackets Center For Agricultural Law And Taxation

Your Guide To The United States Sales Tax Calculator Tax Relief Center

State Income Tax Rates Highest Lowest 2021 Changes

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Iowa Sales And Use Tax Compliance Agile Consulting

State Sales Tax Rates 2022 Avalara

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How To Charge Your Customers The Correct Sales Tax Rates

Iowa Sales Tax Rate Step By Step Business

How To Charge Your Customers The Correct Sales Tax Rates